About MicroFinance ERP:

The United IT MicroFinance ERP is a Micro-Finance Management Software specially developed for

the Microfinance Institutes, NGO’s and Cooperative Societies to automate their work-flow. This

software features integrated Management Information System (MIS), Accounting Management System

(AMS) & Human Resource (HR) modules.

United IT MicroFinance ERP gave you possibility to manage clients and classify them into groups

or centers. You could specify individual details of client account such as personal and family

information, client status, current and closed loan and savings accounts, list of charges and

notes. You could keep track of changes at any time you like so you were always up to date with

any information about your clients

About United IT MicroFinance ERP

• Deliver high-quality, stable software -

• Rapid response to customer's requests for new features.

• Continuous support while whole period of time.

• Product's deployment process must be clearly visible and documented.

Customer's benefits

• Quality of microfinance software.

• Client's data in secure cloud.

• Continuous specialists assistance.

How United IT MicroFinance ERP worked

• Gathering requirements from clients about needs connected with microfinance software.

• Collecting customization settings.

• Help in matching the most suitable configuration.

• Setting up customize software instance.

• Take care of production server, which is always actual, with all fixes.

• Provide individual or group online trainings.

• Import all accounts and balances, if needed.

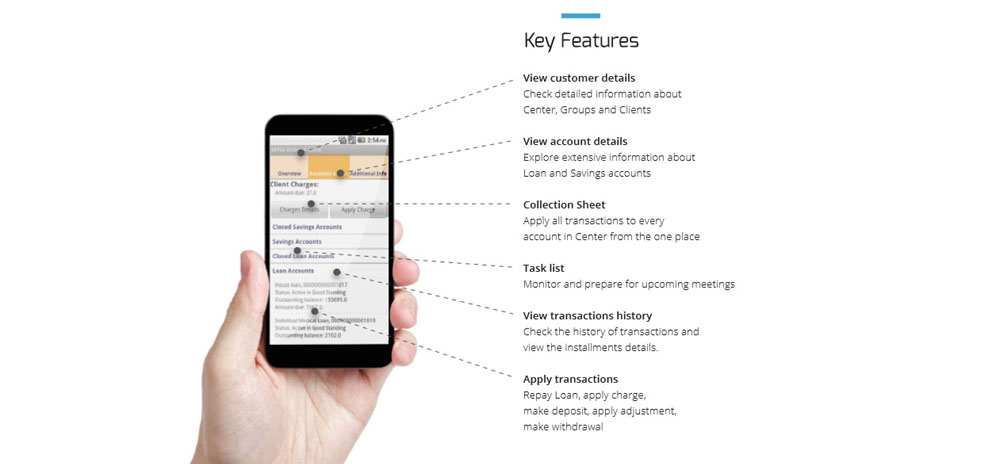

United IT MicroFinance ERP Android Client

United IT MicroFinance ERP Android Client is a mobile version of United IT MicroFinance ERP - management information system which provides functionality for microfinance institutions : client management, portfolio management, loan repayment tracking, fee and savings transactions, and reporting. Mobile client allows user to view the most important information about the customers and accounts and to perform the basic financial operations. Android client is directly connected to full United IT MicroFinance ERP version, so every change performed in the mobile application is automatically reflected in the United IT MicroFinance ERP system.

Branch Management:

A branch management module contains all the information related to division, region

and branch offices. It will manage the MFI's organizational hierarchy.

Features include: New Division Office, New Regional Office, and New Branch

Office & Portfolio-Backlog Transfer.

Product Management:

Products are a financial offering to the customers from MFIs and are governed by

rules specified by the microfinance organizations and these rules are different

for various products.

Features include: Create Loan Product, Assign Service Tax, Create Survey Field,

Loan Gradation, Registration Fee & Written-Off Master.

PO Management:

PO management module consists of group master and employee master. Through group

master user can create new group. Groups are at the heart of the micro finance

methodology. On the other hand employee master helps to store the employee details.

The user can easily assign a group to a PO.

Features include: Create Group, Employee Registration & Assign Group.

User Management:

This module defines access restrictions and user management by using roles. There are five level hierarchies of user based of roles. Such as Administrator, Division Manager, Regional Manager, Branch Manager & Teller. Features include: Create User, Change Password and User data entry status.

Insurance Management:

This module manages the customer death settlement with the Insurance Company.

Features include: Death Document From Branches, Claim Observed, Claim Insurance,

Claim Received, Death Outstanding Settlement & Reclaim Rejected Claim.

Loan Security Management:

Most of group member are not able to pay at a time the security. So we are to collect loan security day to day viz weekly basis. The module able to keep such types of records. The manager can be taken assistance whenever he nees from the module.

Loan Recovery::

It shows the date wise PO. Collection sheet details. It manages the Group wise Loan

Recovery & supports the batch update. Once the payment has been applied in the system,

the system will automatically update the loan outstanding balances, next payment

details and all the respective ledgers.

Due to violations and/or non-repayment etc,

the customer loan account can be marked as "Written-Off" on the basis of "Definition

of lateness"(Written-off master) as defined by the HO. From this state, customer

account can go to "Active- Bad standing" or "Bad Debt". The Bad Debt customer does

not calculate in the Ageing-PAR analysis.

Features Include:Loan Recovery, Sick Payment, Written-off & Bad Debt.

Loan Processing:

Loans help fulfilling the goal of MFIs by providing credit to the customers. With the

help Loan Processing Module MFIs could identify the proper & suitable customer. It

manages the loan documentation & loan processing status. Loan-Recycle system is

maintained by Loan-Recycle sub-module.

Features include: Document Submit, Loan Processing & Loan Recycle.

Loan Processing

Members Registration:

This module takes care of customer survey & group formation. User can manage the

customer survey fields through "Create Survey Field" sub-module. It manages to create

a member, modify member details & transferring members between two groups with backlog

portfolio.

Features include: Customer Survey, Survey Review By BM, Survey Review By RM,

New Member Registration, Edit Member & Group To Group Transfer.

Financial Accounting:

A complete financial accounting module, allowing to do not only the portfolio accountancy

but also the administrative accountancy, that is integrated with all of the other

modules covering features you find in most of the off-the-shelf accounting packages

such as Cashbook, General Ledger, Trial Balance & Cash Flow.

Features include: Account Register, Opening Balance Register, Account Contra

Entry & Journal Entry, Financial Accounting

Fund Management for Head Office:

The fund management module supports fund receive, fund payment, fund allocation to

branch and fund transfer from one branch to another.

Features include: Fund Type Master, Fund Master, Fund Received, Fund Payment &

Fund Allocation.

Fund Management for Branch:

This module takes care of the fund for branch office. The Regional Manager manages

the fund transfer between branches.

Features Include: Fund Received By Branch, Fund Payment By Branch, Fund Transfer

& Branch To Branch Payment.

Loan Disbursement:

When a loan is disbursed to a customer, the system generates an installment amount &

various charges on the basis of the loan product and automatically schedule the loan

due date according to the holiday master and grace period. All the respective ledgers

get updated automatically.

At the time of Loan disbursement, Security amount has been

deposited to Security account against Loan Number on the basis of loan product. When

loan has been paid, the system shows the paid Loan No.

If the customer withdrawals

the security amount, the customer account shows in the "drop out" interface. The user

may drop out the customer account. Death Settlement module manages the customer death.

If a customer is dead, the user may return the security amount to the customer

without paying the loan amount. The loan outstanding is exempted from Reserves &

Surplus Account or any other sources. The dead customer does not calculate in the

Ageing-PAR analysis. Features include: Disburse Loan, Return Security

Amount, Drop Out Member & Death Settlement. This module defines access restrictions

and user management by using roles. There are fife level hierarchies of users based

on roles. Such as Administrator, Division Manager, Regional Manager, Branch Manager

& Teller.

Features Include:Create User, Change Password & User Data Entry Status.